The Greatest Guide To Offshore Company Formation

Table of Contents8 Simple Techniques For Offshore Company FormationAll About Offshore Company FormationLittle Known Facts About Offshore Company Formation.Excitement About Offshore Company Formation

Hong Kong enables production of offshore business as well as offshore savings account if your firm does not sell Hong Kong region. Also, in this situation, there will certainly be no corporate tax applied on your revenues. Offshore firms in Hong Kong are eye-catching: stable jurisdiction with superb credibility and a dependable overseas financial system.

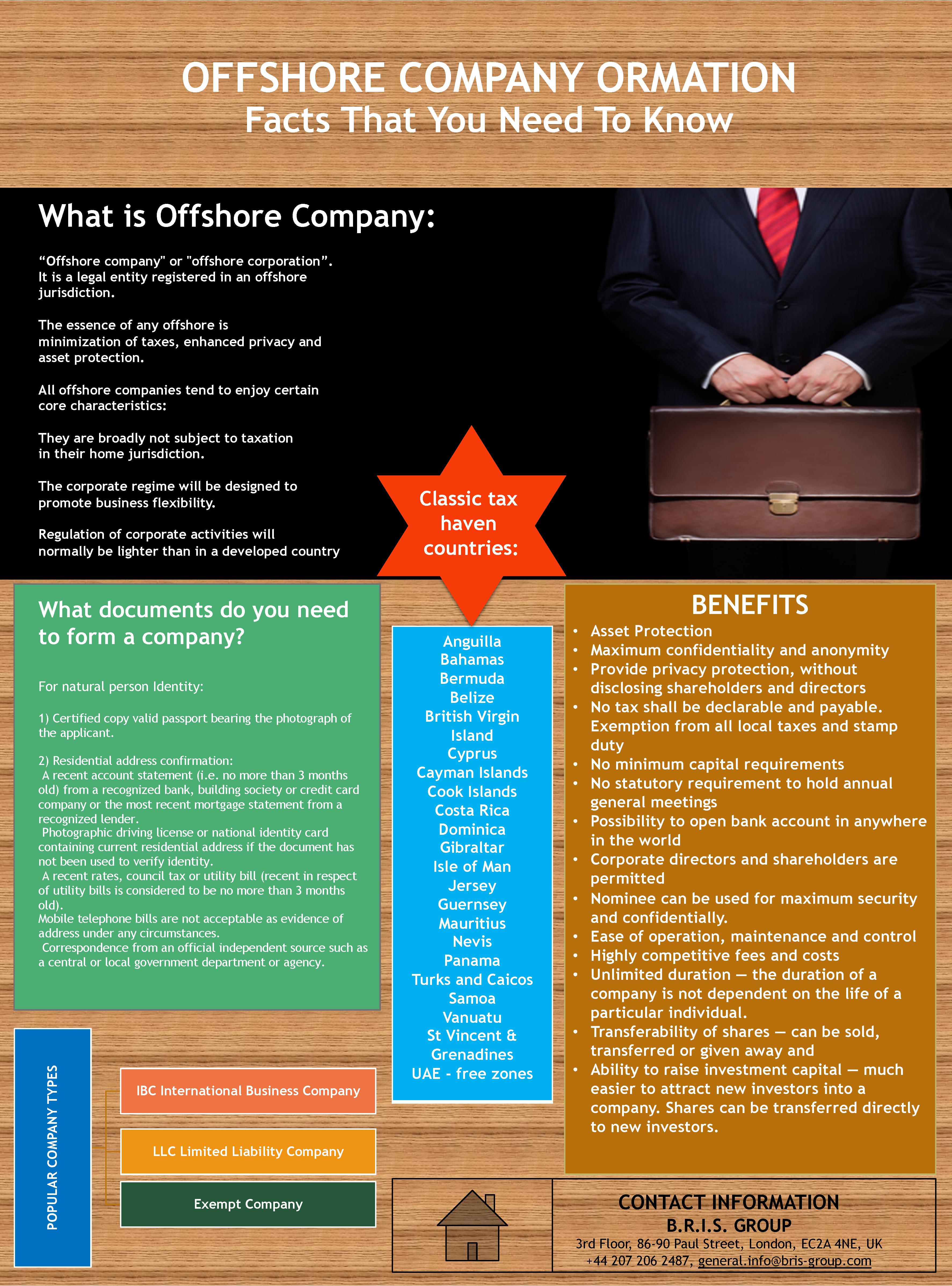

Although there are no clear distinctions due to the private company regulations of each nation, normally the main differences are tax structure, the level of privacy as well as possession protection. Lots of countries intend to attract international companies as well as capitalists by introducing tax obligation regulations friendly to non-residents as well as worldwide firms. Delaware in the USA as an example is historically one of the most significant tax obligation sanctuaries in the world.

Offshore tax obligation havens are usually labelled as a means for tax evasion. This is often because of their rigorous secrecy and also property defense laws as they are not obliged to report or expose any type of information to your nation of residence. That does not imply you do not have to comply with regulations where you are resident in terms of monetary coverage commitments.

Offshore Company Formation Fundamentals Explained

The term offshore describes the company not being resident where it is officially integrated. Commonly much more than not, the directors as well as other members of an overseas company are non-resident additionally contributing to the firm not being resident in the country of enrollment. The term "overseas" might be a bit complicated, since several modern-day monetary centres in Europe, such as Luxembourg, Cyprus and Malta supply worldwide business entities the exact same advantages to non-resident companies as the traditional Caribbean "tax obligation places", however usually do not use the term offshore.

That does not indicate you do not have to comply with legislations where you are resident in terms of monetary reporting obligations. The privacy by having an offshore company is not about concealing assets from the federal government, yet regarding personal privacy and also protection from unwarranted claims, hazards, partners and various other lawful disagreements.

The term offshore as well as confusion bordering such business are frequently connected with illegalities. Offshore firms act like any kind of regular company yet are held in various territories for tax obligation objectives thus giving it benefits. This does not indicate it acts illegal, it's merely a way to optimise an organization for tax and also safety functions.

Getting The Offshore Company Formation To Work

These are frequently limiting requirements, high overheads as well as disclosure policies. Although any individual can begin a firm, not every can get the same advantages. One of the most typical benefits you will discover are: Easy of registration, Marginal fees, Adaptable monitoring as well as very little reporting requirements, No foreign exchange restrictions, Favourable neighborhood business regulation, High confidentiality, Tax obligation advantages, Very little or no constraints in relation to organization tasks, Relocation opportunities Although view publisher site it truly depends upon the legislations of your nation of house as well as how you want to optimise your service, normally online organizations and anything that is not depending on physical infrastructure often has the best benefits.

Activities such as the below are the most usual as well as beneficial for offshore enrollment: Offshore financial savings and investments Forex and stock trading, E-commerce Expert solution company Net solutions Global based business, Digital-based Firm, International trading Possession of copyright Your nation of house will eventually specify if you can become totally tax-free or otherwise (offshore company formation).

This listing is not exhaustive and also does not always use to all territories, these are usually sent out off to the registration office where you desire to register the business.

is a venture which only performs financial tasks outside the nation in which it is signed up. So, an offshore firm can be any kind of enterprise which does not run "at home". At the exact same time, according to public opinion, an overseas firm is any kind of business which appreciates in the country of registration (offshore company formation).

The Facts About Offshore Company Formation Revealed

Establishing up an offshore company seems complicated, but it worth the effort. An usual factor to establish up an overseas business is to satisfy the lawful demands of the nation where you want to purchase building.

Due to the fact that privacy is among one of the most important facets of our job, all information entered upon this form more info here will certainly be maintained strictly confidential (offshore company formation).

Even before going right into check over here details on how an overseas company is formed, we first require to comprehend what an offshore company really is. This is a company entity that is developed and also operates outside your country of house. The term 'offshore' in money refers to business techniques that are situated outside the owner's national limits.